Mining Taxes 101

As a retail miner, there are some tasks you must do to properly report taxes by the end of the year as a hobby or quarterly as a business.

- Taxable income on rewarded coin

- Capital gain/loss if disposed any coin to cover expenses

The most annoying tax calculation is attributing Reward Transactions with the correct cost basis.

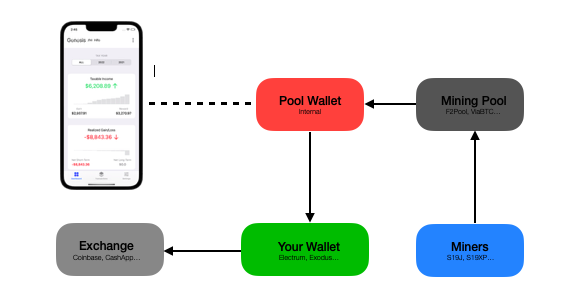

Mining Pool, Wallet and Exchange

There are few different ways to setup the mining operation, here is a prefered way to set up with a mining pool:

- Miners send hash to Mining Pool (taxable event)

- Reward will be deposited into a Pool Wallet then occasionally transfers to Your Wallet

- Occasionally you transfer coins to Exchange for Fiat (taxable event)

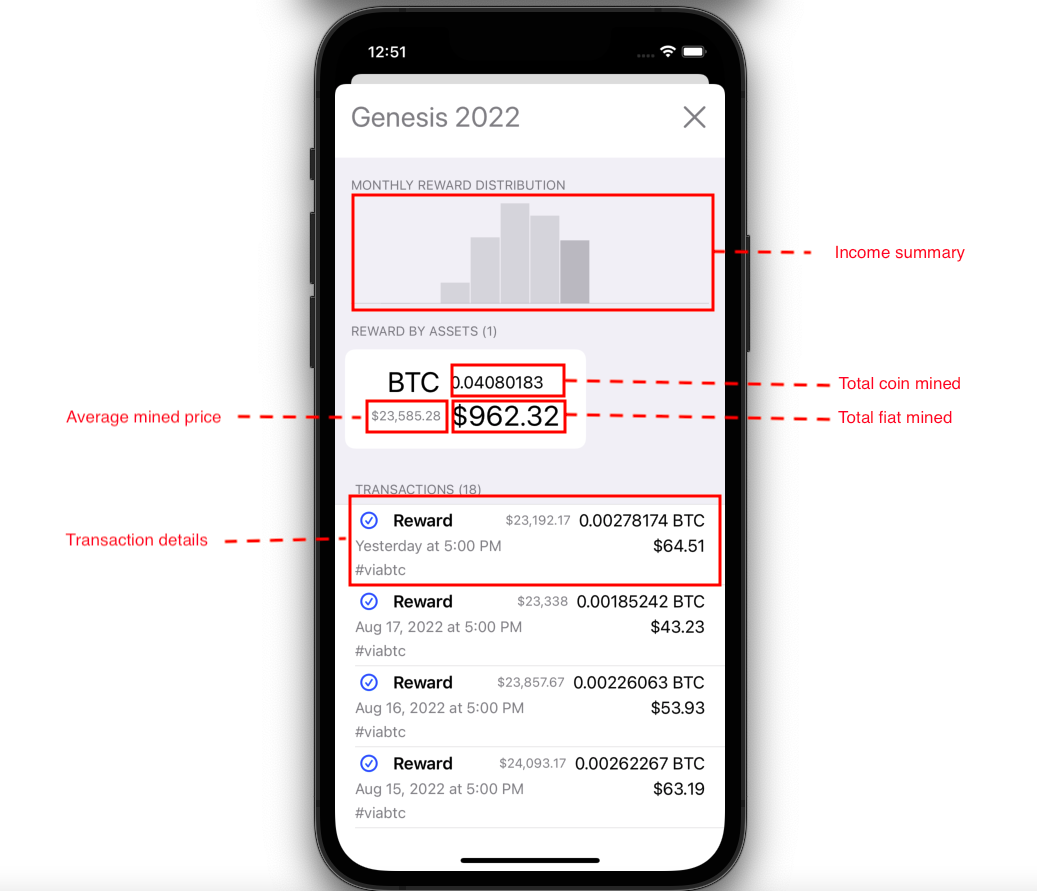

CoinTrail To Rescue

With CoinTrail integrated directly into the mining pool, Reward and Withdraw transactions are synced to your device. Cost Basis, Taxable Income, and Gain/Loss are automatically recorded. Income can be drilled down monthly for details, and trends.